Over 50% of the US workforce live paycheck to paycheck.

Small amounts of earning or expense volatility can disrupt a

Over the past decade Americans have said that financial worry is their greatest strain regarding health and wellness.

-

$32B

In bank overdraft fees and non-sufficient funds fees

-

$9B

In substantial payday lending fees and high interest rates

-

17k

Payday lending locations and online sites available to consumers in the U.S.

-

$6B

In lending fees accumulated at over 11,000 U.S. pawn shops

-

$5B

Total title loan fees, with one out of every six borrowers facing vehicle forfeiture

-

46%

Percentage of employees who spend over three hours during the workweek dealing with financial issues

Employee Retention

FlexWage provides instant access to earned wages building employee loyalty and increases retention.

Increased Productivity

You eliminate financial stress for your employees, and develop a more productive, satisfied workforce.

Cost Savings

FlexWage saves your company money by driving adoption of electronic pay to eliminate the expense of paper checks.

Revolutionize your company’s financial wellness benefit program with our fully-compliant and accurate on-demand pay solutions and financial wellness tools. With FlexWage you get the first and only patented solution from the most experienced, automated and trusted company in the industry.

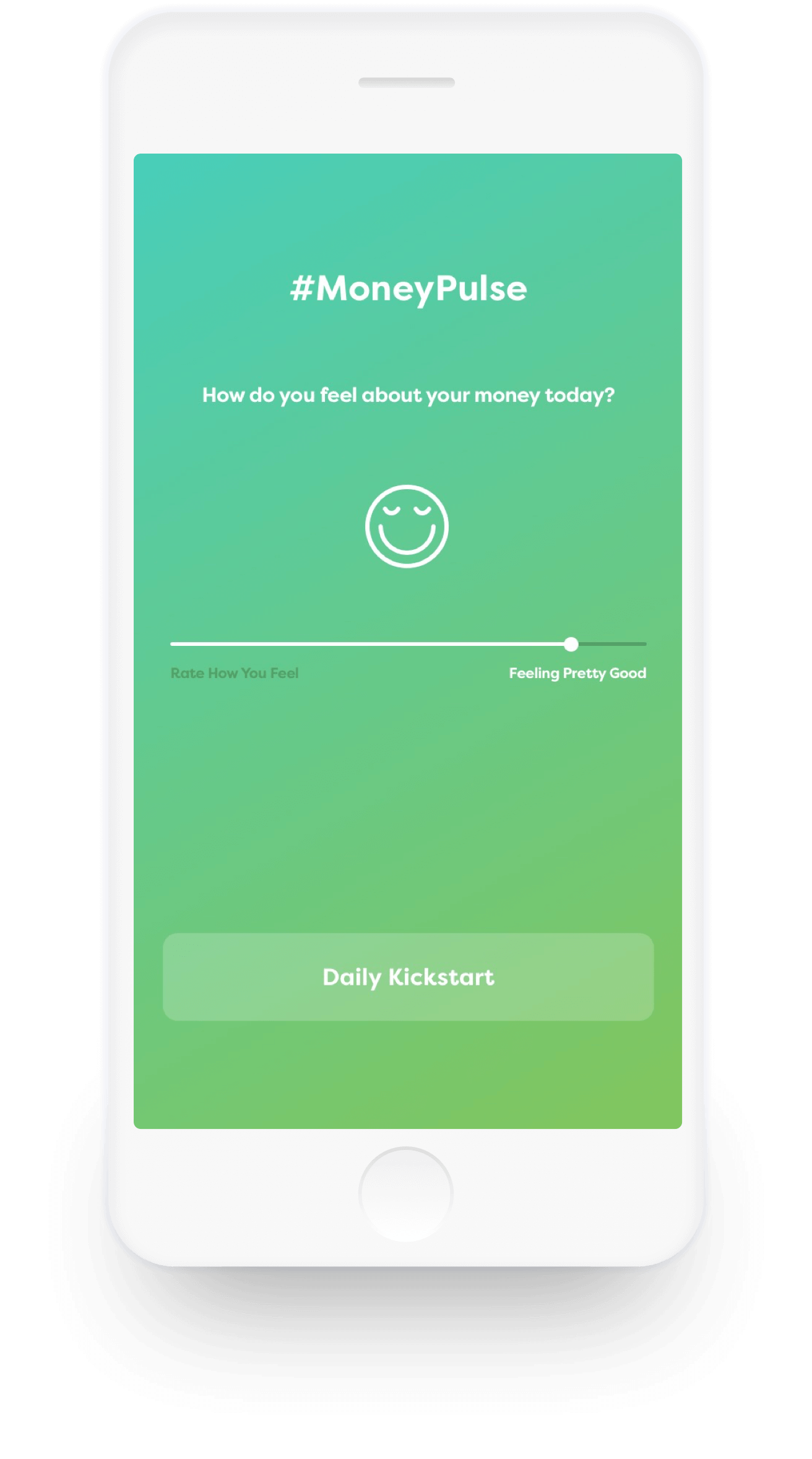

Meet Cordi, a Financial Wellness Coach.

What financially vulnerable people need is access to high-quality products and experiences built to help them succeed by people who truly understand their financial situations and foibles. They need real-time advice and guidance, tailored to their specific situation and immediately actionable.

Jennifer Tescher, CFSI Founder and CEO, from The Problem with Financial Literacy